Jose Mier Discusses Lower Costs in Sun Valley, CA

Jose Mier lives in Sun Valley, CA and knows that median home prices are lower here than other parts of Los Angeles.

The San Fernando Valley, located in the heart of Southern California, is a sprawling and diverse region known for its vibrant communities, scenic landscapes, and thriving real estate market. In recent years, the median home prices in this area have been a topic of great interest and discussion. This article delves into the dynamics of the San Fernando Valley’s real estate market, exploring the trends, factors influencing home prices, and the implications for both residents and potential buyers.

Historical Trends

To understand the current state of median home prices in the San Fernando Valley, it’s essential to examine historical trends. Over the past few decades, the Valley’s real estate market has experienced significant fluctuations. In the 1980s and early 1990s, the Valley witnessed a boom in real estate, with prices steadily increasing. However, the market took a severe hit during the housing crisis of 2008, leading to a sharp decline in property values.

Following the housing market crash, the San Fernando Valley, like many other areas, went through a period of recovery. Prices gradually began to rise again, reaching pre-recession levels by the mid-2010s. Since then, the market has shown signs of strength, with median home prices continuing to climb.

Current Median Home Prices

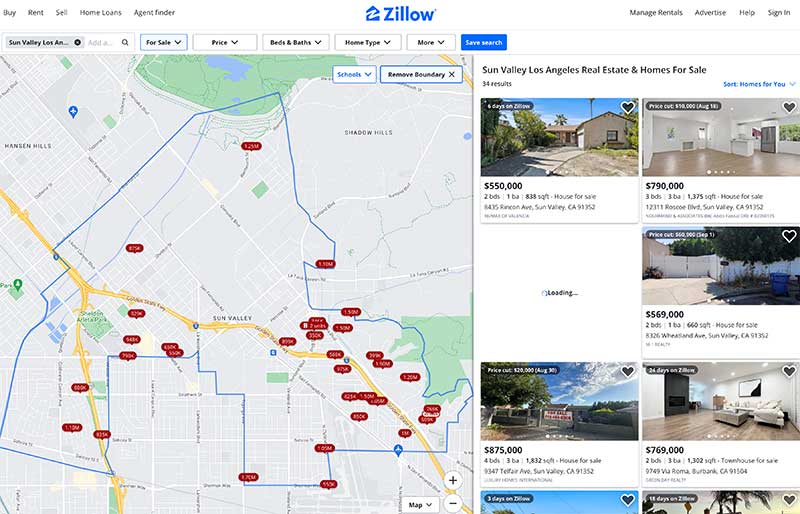

As of the most recent data available (as of September 2021), the median home price in the San Fernando Valley was around $800,000. However, it’s important to note that this figure can vary significantly depending on the specific neighborhood within the Valley. Some neighborhoods have median prices well above this average, while others are more affordable.

For instance, neighborhoods like Encino, Studio City, and Calabasas often have median prices above $1 million, reflecting their desirability and upscale amenities. On the other hand, areas like Panorama City and North Hills tend to have lower median prices, making them more accessible to a wider range of homebuyers.

Factors Influencing Median Home Prices

Several factors contribute to the median home prices in the San Fernando Valley. Understanding these factors is essential for comprehending the dynamics of the real estate market in this region:

- Location: Location plays a significant role in determining home prices. Neighborhoods closer to job centers, entertainment hubs, and excellent schools tend to command higher prices. Proximity to attractions like Griffith Park or Universal Studios can drive up property values.

- Housing Demand: The demand for housing in the San Fernando Valley is consistently high due to its appealing climate and proximity to Los Angeles. The limited supply of homes can push prices upward.

- Economic Factors: Economic conditions, including employment opportunities and income levels, can affect home prices. A strong local job market can drive demand and contribute to higher prices.

- Interest Rates: Mortgage interest rates have a direct impact on affordability. When rates are low, buyers can afford higher-priced homes, which can contribute to rising median prices.

- Housing Inventory: The availability of homes for sale influences prices. A shortage of inventory can result in bidding wars and increased competition among buyers, leading to higher prices.

- Real Estate Speculation: Speculative activity by investors can influence the market. Fluctuations in investor interest can lead to price volatility.

- Government Policies: Policies related to zoning, land use, and housing development can impact home prices. For example, restrictions on new construction may limit the housing supply, driving up prices.

Implications for Residents

The rising median home prices in the San Fernando Valley have various implications for current residents:

- Home Equity: Existing homeowners often benefit from increasing property values, as their home equity grows. This can provide financial stability and opportunities for refinancing or leveraging their equity for other investments.

- Property Taxes: Rising home values can lead to higher property tax bills for homeowners. This can be a concern for some residents, especially those on fixed incomes.

- Affordability Challenges: The increasing cost of homeownership can make it challenging for new buyers to enter the market. Many individuals and families may find it difficult to afford homes in their desired neighborhoods.

- Rental Market: High home prices can also impact the rental market, as some individuals and families may choose to rent rather than buy. This can lead to increased demand for rental properties and potentially higher rents.

Implications for Potential Buyers

For potential buyers considering a home purchase in the San Fernando Valley, the current state of median home prices presents both opportunities and challenges:

- Investment Potential: Despite the high prices, real estate in the San Fernando Valley can be a sound long-term investment. Historically, property values have generally appreciated over time, offering potential for future gains.

- Affordability Constraints: High median home prices can make it difficult for first-time buyers to enter the market. Buyers may need to explore alternative financing options or consider more affordable neighborhoods.

- Competition: The competitive nature of the real estate market can result in bidding wars, making it essential for buyers to be prepared, pre-approved for a mortgage, and willing to act swiftly.

- Long-Term Commitment: Given the significant financial investment involved, buying a home in the San Fernando Valley is a long-term commitment. Buyers should carefully assess their financial readiness and long-term goals.

Future Outlook

Predicting the future of median home prices in the San Fernando Valley is challenging, as it depends on a multitude of factors. However, several trends and developments may impact the real estate market in the region:

- Interest Rates: The direction of mortgage interest rates will continue to play a crucial role in affordability. Rising rates can put downward pressure on home prices, while lower rates can stimulate demand.

- Economic Factors: The overall health of the local and national economies will influence the demand for housing. Job growth and wage levels will be key indicators to watch.

- Housing Inventory: Efforts to increase housing supply through new construction or zoning changes may affect future home prices. An increase in inventory could alleviate some of the upward pressure on prices.

- Government Policies: Ongoing policy changes related to housing, such as rent control or incentives for affordable housing, can impact the real estate market’s dynamics.

- Market Sentiment: Consumer sentiment and investor confidence can have a significant influence on the market. Changes in sentiment can lead to fluctuations in demand and pricing.

In conclusion, the median home prices in the San Fernando Valley have shown a consistent upward trend in recent years, reflecting a combination of factors such as location, demand, economic conditions, and interest rates. While this presents opportunities for existing homeowners and investors, it also poses affordability challenges for potential buyers. The future of the market will depend on a complex interplay of economic, policy, and market dynamics, making it crucial for both residents and buyers to stay informed and make well-informed decisions in the ever-evolving real estate landscape of the San Fernando Valley.