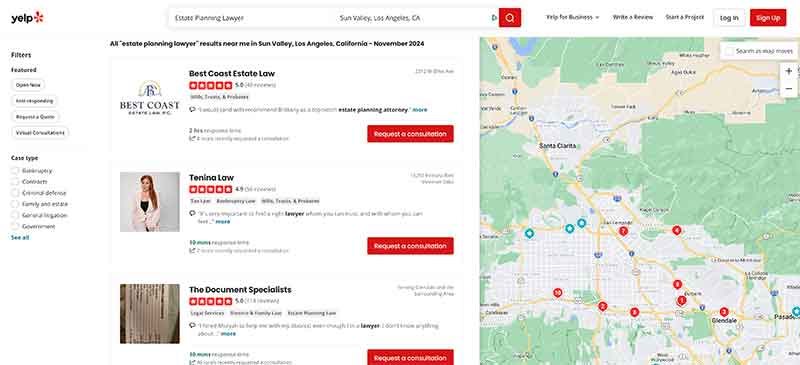

Jose Mier finds items of interest to Sun Valley, CA residents like himself. One eventual need is for an estate planning attorney, of which there are several in the area to choose from. Just check out this Yelp results page for an example.

Estate planning is a critical aspect of financial and personal management that ensures your assets and intentions are handled according to your wishes after your passing or in the event of incapacitation. At the center of this important process are estate planning attorneys—legal professionals specializing in crafting and implementing personalized strategies to help individuals and families secure their legacies. With their expertise, estate planning attorneys offer invaluable guidance, mitigate risks, and bring peace of mind to clients navigating complex legal and financial decisions.

The Role of Estate Planning Attorneys

Estate planning attorneys, often referred to as probate or elder law attorneys, specialize in the legal aspects of estate management, inheritance, and asset distribution. Their responsibilities include drafting wills, setting up trusts, and creating powers of attorney and healthcare directives. These documents form the backbone of an estate plan, ensuring that your financial assets, property, and personal wishes are managed and transferred according to your preferences.

Key functions of estate planning attorneys include:

- Creating Wills and Trusts

A will is a foundational estate planning document that outlines how your assets should be distributed after your death. An estate planning attorney ensures that your will meets all legal requirements, is clearly articulated, and minimizes the chances of disputes.

Trusts, on the other hand, provide more nuanced control over your assets, allowing for conditions on distribution, tax advantages, and privacy. Attorneys advise on the right type of trust, such as revocable living trusts, irrevocable trusts, or special needs trusts, based on your goals. - Avoiding Probate

Probate is the legal process through which a deceased person’s estate is settled and assets are distributed. It can be time-consuming, costly, and public. Estate planning attorneys employ strategies to minimize or entirely avoid probate by structuring assets through joint ownership, beneficiary designations, and trusts. - Tax Planning

High-net-worth individuals and families often face significant estate and inheritance taxes. Estate planning attorneys are well-versed in tax laws and use their expertise to structure plans that minimize tax liabilities, protecting the value of the estate for heirs. - Incapacity Planning

An estate planning attorney also prepares documents that address potential incapacity, such as durable powers of attorney and advance healthcare directives. These tools ensure that trusted individuals are authorized to manage finances or make healthcare decisions on your behalf. - Navigating Complex Family Dynamics

In cases involving blended families, estranged relatives, or conflicting interests among beneficiaries, estate planning attorneys provide neutral, professional guidance to create fair and enforceable plans. Their expertise can prevent future disputes and protect relationships.

Why Hire an Estate Planning Attorney?

Estate planning can be complex, particularly for individuals with significant assets, business interests, or unique family circumstances. While online templates for wills and trusts are readily available, these generic tools often fail to account for the nuances of individual situations and may lead to unintended consequences.

Hiring an estate planning attorney provides several distinct advantages:

- Personalized Planning

Every estate is unique, and an attorney tailors your plan to your specific financial situation, family structure, and goals. They consider factors such as state laws, tax implications, and contingencies to create a comprehensive plan. - Legal Expertise

Estate planning attorneys are well-versed in federal and state laws that govern inheritance, property rights, and taxation. They ensure compliance with these laws and protect your plan from challenges or invalidation. - Avoiding Errors

Mistakes in estate planning documents can lead to costly legal disputes, tax burdens, or the unintended distribution of assets. Attorneys meticulously draft and review documents to avoid errors and ambiguities. - Updating Plans Over Time

Life circumstances change, and so do laws. Estate planning attorneys help you update your plan as needed to reflect changes in your family, finances, or legal landscape.

Common Challenges in Estate Planning

While estate planning is a proactive step, it is not without challenges. Estate planning attorneys help clients navigate these obstacles effectively:

- Family Disputes

Contentious relationships or ambiguous intentions can lead to disputes among heirs. Attorneys mediate discussions and create legally binding documents to minimize conflicts. - Blended Families

In cases of remarriage, ensuring that both a current spouse and children from previous marriages are fairly provided for can be challenging. Attorneys design equitable plans that address these dynamics. - Business Succession

For business owners, planning for the transition of ownership and leadership is critical. Attorneys integrate business succession plans into the broader estate strategy, ensuring continuity and protecting value. - Special Needs Planning

Families with dependents who have disabilities require careful planning to ensure that inheritance does not disqualify them from receiving government benefits. Special needs trusts, crafted by an attorney, address this concern. - Unclear Beneficiary Designations

Misaligned or outdated beneficiary designations on accounts and policies can undermine an estate plan. Attorneys ensure that all documents and designations align with the client’s wishes.

Types of Clients Who Benefit from Estate Planning Attorneys

Estate planning attorneys serve a diverse range of clients, each with unique needs:

- Young Families

Parents with minor children often seek estate planning to designate guardians and establish trusts for their children’s care and education. - High-Net-Worth Individuals

Those with substantial assets require advanced strategies to reduce tax liabilities and preserve wealth for future generations. - Elderly Individuals

Older clients often prioritize healthcare directives, Medicaid planning, and ensuring that their estates are in order. - Business Owners

Entrepreneurs benefit from estate planning attorneys who integrate personal and business planning, including succession strategies. - Blended Families

Estate planning attorneys help navigate complex dynamics to ensure that all family members are provided for according to the client’s wishes.

Choosing the Right Estate Planning Attorney

Selecting the right attorney is crucial for a successful estate plan. Consider the following when choosing an estate planning attorney:

- Specialization

Look for attorneys who specialize in estate planning and have a track record of handling cases similar to yours. - Experience

An experienced attorney understands the intricacies of estate law and has the expertise to address complex situations. - Reputation

Research reviews and testimonials, and consider referrals from trusted sources to find an attorney with a strong reputation for professionalism and effectiveness. - Communication

Choose an attorney who listens attentively, explains concepts clearly, and makes you feel comfortable discussing sensitive topics. - Fees

Understand the attorney’s fee structure, whether flat-rate or hourly, and ensure it aligns with your budget and the complexity of your plan.

The Future of Estate Planning

As technology advances and societal norms evolve, estate planning attorneys are adapting to meet new challenges. Digital assets, such as cryptocurrency and online accounts, require unique strategies for preservation and transfer. Additionally, increased globalization means that many clients need cross-border estate planning to address assets in multiple jurisdictions.

Estate planning attorneys are also leveraging technology to streamline processes. From virtual consultations to document automation, these innovations make estate planning more accessible and efficient.

Estate planning attorneys play an indispensable role in helping individuals and families secure their legacies and protect their loved ones. By combining legal expertise with personalized guidance, they create comprehensive plans that address financial, personal, and familial concerns. Whether you’re drafting a simple will or navigating complex tax strategies, an estate planning attorney ensures that your wishes are respected and your assets are preserved. With their support, you can achieve peace of mind, knowing that your legacy is in capable hands.